Year-to-date M&A volume in sector up by 18% despite global economic & political events. Deal activity driven by digitally-enabled companies, with strong appetite from both financial & strategic buyers.

At the Q3 stage of the year we can report that M&A activity remains buoyant and growing despite continued geopolitical headwinds. Our Global M&A Update details the M&A deal activity throughout the year-to-date deal activity up to Q3 2022 and reports global resilience in the tech, digital, media and marketing sectors.

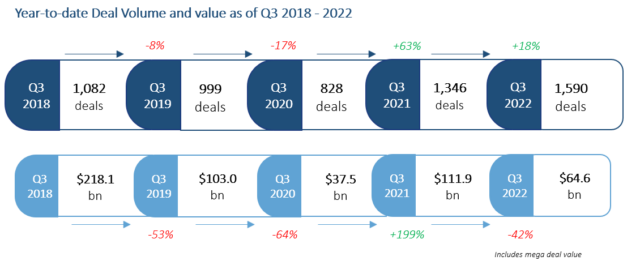

Ciesco tracked 1,590 transactions to date in the first three quarters of 2022 in the technology, digital and media sectors. The sector experienced an 18% rise over Q3 2021 levels (1,346) and a 92% increase over that of Q3 2020 (828). The total value of announced deals, including mega-deals (defined as deals over £10bn) was $64.6bn, a 42% decrease from Q3 2021. 2 mega deals were announced to date – in Q1 (The Nielsen Company acquired by Evergreen Coast Capital for $16 billion) and Q2 (Zendesk acquired by Permira for $10.2 billion).

YTD Q3 2022 continued its global M&A deal success – with buyers acquiring targets from 63 different countries.

Private Equity firms / buyers continue to be a strong buyer category in the sector, making a total of 683 acquisitions which represented an 11% growth compared with Q3 2021, and constitutes 43% of all sector activity. Strategic acquirers increased their activity by 24% (907) compared with Q3 2021 (732), making up a total of 57% of overall deal activity.

Consultancies, tech companies and media owners contributed to an increasingly diverse buyer universe, driven by the need for smart use of data, seamless UX, eCommerce and subscription models. We expect this trend to continue as the market grapples with uncertainty around the global growth outlook.

Ciesco Q3 2022 M&A Update

The report features:

- Our deal activity analysis by Volume, Disclosed values, Buyer categories, Geographical regions and Target sectors

- Insights and trend analysis of Private Equity-backed activity, along with an overview of the buyer landscape

Whether you are a potential investor, a strategic buyer or a stakeholder planning the future for your business, we hope you find the information in this update insightful and informative. All reported data on deal activity is overlaid with our perspectives and insights, reflecting our substantial knowledge and understanding of the overall industry.

The MarTech/AdTech and digitally-enabled sectors are resilient despite the challenging geopolitical and economic situation and climate that we are experiencing. We are seeing a continued increase in deal activity in the sector with an 18% increase YoY, including across both largest M&A markets – USA and UK – which are accounting for a combined 56& of total deal volume. Digital transformation remains a key focus of the businesses globally. This with the need for further and more effective consolidation is playing a significant role in driving the M&A activity in the sector.