2022 was a buoyant year for M&A deal activity in the technology, digital, media and marketing sectors.

Year-to-date M&A volume in sector up by 20% despite dramatic negative shift in macro conditions and outlook. Deal activity was driven by those with tech and digital-led capabilities, with continued appetite from both financial & strategic buyers.

We are pleased to present Ciesco’s 2022 Global M&A Review & 2023 Outlook. We can report that while M&A markets have become more volatile and fragile over the course of 2022, there is continued deal activity in the technology, digital, media and marketing sectors.

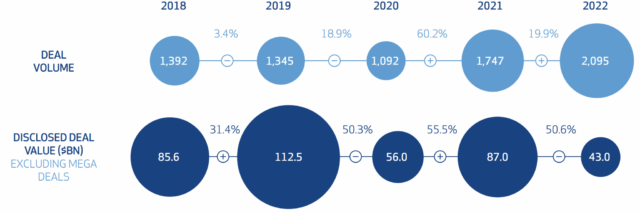

Ciesco tracked 2,095 transactions in 2022 in the technology, digital and media sectors. The sector experienced a 20% rise over 2021 levels (1,747) and a 92% increase over that of 2020 (1,091). The total value of announced deals, excluding mega-deals (defined as deals over £10bn) was $43.0bn, a 50.6% decrease from 2021 ($87.0bn). 3 mega deals were announced – in Q1 (The Nielsen Company acquired by Evergreen Coast Capital for $16 billion); in Q2 (Zendesk acquired by Permira for $10.2 billion); and in Q4 (Twitter acquired by Elon Musk for $44 billion).

2022 continued its global M&A deal success – with buyers acquiring targets from 70 different countries.

As we entered the year 2022, very few of us anticipated an outright, prolonged war in Central Europe; China-related supply chain and continued COVID issues; a surge in inflation towards double digits and rising energy prices; a universal and significant rise in interest rates, triggering a huge rise in cost of living which in turn would create a social as well as economic crisis and a sharp downward rating in stock markets. Business leaders were already in the process of re-imagining their businesses to adapt to the “new normal” following the COVID pandemic years. The events of 2022 provided further challenges which some leaders translated into opportunities to accelerate their planned business transformation programmes.

Private Equity firms / buyers continue to be a strong buyer category in the sector, making a total of 874 acquisitions which represented an 11% growth compared with 2021 (784), and makes up 42% of all sector activity. Strategic acquirers increased their activity by 27% (1,221) compared with 2021 (964), making up a total of 58% of overall deal activity.

Consultancies, tech companies and media owners continued to contribute to an increasingly diverse buyer universe, driven by the need for smart use of data, seamless UX, eCommerce and subscription models. We expect this trend to continue as the market grapples with uncertainty around the global growth outlook.

Ciesco’s 2022 Global M&A Review & 2023 Outlook features:

- Our deal activity analysis by Volume, Disclosed values, Buyer categories, Geographical regions and Target sectors

- Insights and trend analysis of Private Equity-backed activity, along with an overview of the buyer landscape

- Guest Editorials from senior industry leaders, including Currys plc, R3 Worldwide, Panmure Gordon, CIL Management Consultants, Capgemini, and IPG Health

Whether you are a potential investor, a strategic buyer or a stakeholder planning the future for your business, we hope you find the information in this update insightful and informative. All reported data on deal activity is overlaid with our perspectives and insights, reflecting our substantial knowledge and understanding of the overall industry.

Download the report

Read our full review of 2022 and our outlook for 2023 for M&A activities in technology, media and healthcare.